Strategic IT Partnerships for Accelerating Startups Growth

Venture capital is fundamentally about placing bold bets on the future. Yet, success is not just about capital infusion—it requires strategic foresight, operational efficiency, and the ability to mitigate risk effectively. In an increasingly complex and technology-driven world, one of the most powerful ways VC partners can ensure the success of their investments is by engaging with experts who bring specialized knowledge, execution capabilities, and industry insights.

Beyond Capital: The Need for Strategic Expertise

While financial backing is essential, capital alone does not guarantee a startup’s success. Many early-stage companies struggle with:

- Product-market fit – Understanding how their technology or solution aligns with market demands.

- Technology selection – Choosing the right frameworks, platforms, and tools for scalability.

- Operational scalability – Establishing a robust foundation for future growth.

- Regulatory compliance & security – Navigating complex legal and security requirements.

Engaging with domain experts helps bridge these gaps, enabling startups to make informed decisions that maximize their probability of success. Firms like co.brick, for example, provide not only technical expertise but also project leadership and access to specialized knowledge in AI, IoT, and cybersecurity.

Accelerating Growth with Expert-Led Execution

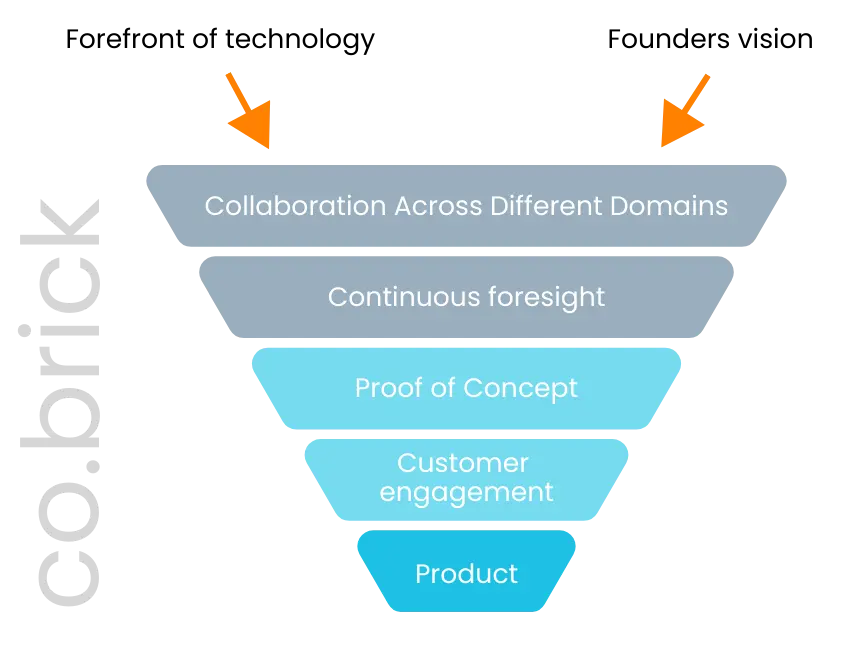

A well-structured engagement with subject matter experts ensures that startups move efficiently through critical phases of development. Take, for instance, the five-step approach adopted by co.brick:

- Understanding the Vision – Working closely with founders to align on objectives, challenges, and constraints, ensuring a clear roadmap.

- Prototype Development & Business Analysis – Rapid prototyping to refine product concepts, accelerate early validation, and fine-tune requirements.

- Rapid Team Assembly & Agile Execution – Assembling specialized teams, from business analysts to security experts, within weeks to drive development forward.

- Agile & Transparent Collaboration – Implementing structured agile methodologies with continuous feedback loops to keep stakeholders aligned.

- Long-Term Value Creation & Structuring – Ensuring startups have a scalable, stable operational framework that appeals to future investors.

Harnessing Cross-Domain Synergies for Scalable Innovation

One of the most overlooked advantages of expert engagement is the ability to create cross-domain synergies. Startups often focus on solving industry-specific problems, but many of the most successful innovations emerge when technologies and insights from multiple domains converge. Experts who have experience across sectors—such as enterprise software, AI, security, and IoT—bring a unique perspective that enables startups to unlock new opportunities.

For example, an AI startup working in financial services might benefit immensely from insights from cybersecurity professionals, ensuring robust data protection and compliance with industry regulations. Similarly, an IoT company building smart city solutions could accelerate deployment by leveraging best practices from enterprise cloud infrastructure experts.

De-Risking Investments with Proven Methodologies

The startup failure rate remains high—over 90% of startups fail, with 70% failing within the first five years. Many of these failures stem from poor execution rather than flawed ideas. VC firms can mitigate these risks by embedding proven methodologies and best practices into their portfolio companies.

For instance, co.brick employs best-of-best practices such as:

- IoT integration – Ensuring seamless hardware and software connectivity.

- Custom software development – Tailoring scalable solutions that evolve with market needs.

- Cloud and edge computing – Optimizing data storage and real-time processing capabilities.

- Security and compliance – Implementing stringent security measures to protect intellectual property and sensitive data.

Startups that integrate such an expert-driven approach can avoid common pitfalls, making them more attractive for follow-on funding and eventual exits.

Unlocking Growth Through Hardware and Software Integration

One of the most significant advantages that VC firms gain from expert involvement is the ability to differentiate their portfolio companies in highly competitive markets. Having a strong technical foundation can transform a promising idea into a disruptive force within an industry.

Take, for example, the rapid evolution of artificial intelligence. Startups that leverage AI-driven automation, predictive analytics, and machine learning can scale faster and serve customers more efficiently. However, AI implementation requires a deep understanding of data infrastructure, model optimization, and ethical AI considerations. Without expert guidance, a startup might waste valuable time and resources on ineffective AI strategies, risking failure in execution.

Additionally, hardware and software connectivity is crucial in modern product development. At co.brick, we are experts in this field, not only by developing our own Observe project —a solution designed to simplify data-driven decisions, accelerate insights, and empower workflow—but also by assisting our partners in integrating hardware components into their products. By ensuring seamless connectivity and optimizing the interaction between software and hardware, we help startups enhance their product capabilities and create a more competitive offering in the market.

Case Study: How Expert Engagement Fuels Scalable Growth

Consider a VC-backed startup in the industrial IoT sector aiming to build a predictive maintenance platform. The startup might have a strong business model but lack the technical knowledge required to build a scalable and secure IoT infrastructure. By collaborating with industry experts, the startup can:

- Select the right hardware and sensors for data collection.

- Implement real-time analytics to predict machine failures.

- Ensure secure data transmission through advanced encryption.

- Optimize cloud and edge computing to reduce latency and costs.

Without expert guidance, the company might struggle with integration challenges, security vulnerabilities, and performance bottlenecks—ultimately delaying market entry and eroding investor confidence.

Why Expert Engagement Is More Critical Than Ever

The technology landscape is evolving at an unprecedented pace, particularly in the realm of the Internet of Things (IoT). From edge computing and AI integration to smart cities and autonomous systems, startups now operate in an environment where staying ahead of the curve requires constant innovation. However, innovation without direction can be just as risky as stagnation.

By embedding expert engagement into their investment thesis, VC firms can ensure that their startups:

- Make informed technological decisions rather than experimenting blindly.

- Reduce execution risk by leveraging proven methodologies.

- Shorten time to market through rapid iteration cycles.

- Enhance scalability and long-term viability by focusing on sustainable technology adoption.

A Smarter Approach to Venture Success

VC firms must evolve beyond their traditional role as financiers and become strategic enablers of innovation. Engaging with industry experts not only helps de-risk investments but also accelerates the path to market leadership for portfolio companies. Firms like co.brick exemplify how a blend of capital, expertise, and agile execution can transform startups into high-growth ventures.

At co.brick, we embrace the concept of the Perfect Trio: Founder, Investor, and Tech Partner—where we play the role of the Tech Partner to ensure that startups have the right technological backbone to succeed. By bringing together visionary founders, forward-thinking investors, and expert-driven technology execution, we create a synergistic ecosystem that maximizes growth potential.

Conclusion

By prioritizing expert-driven investment strategies, VC partners can maximize returns, enhance portfolio resilience, and create sustainable long-term value—ensuring their startups don’t just survive but thrive in the competitive landscape of tomorrow.

The future of venture capital lies in the ability to identify, support, and scale the next wave of groundbreaking startups. The difference between a successful portfolio and one that struggles is often determined by the expertise embedded in its execution strategy. By embracing the power of expert engagement, VC firms can significantly improve the success rate of their investments, build stronger market disruptors, and unlock unparalleled growth potential.

Enjoyed this article? Don't miss out! Join our LinkedIn community and subscribe to our newsletter to stay updated on the latest business and innovation news. Be part of the conversation and stay ahead of the curve.

Transform your business with our expert